Resale Cases

Resale Property Transaction

There are two types of Resale transaction that gets executed in the marketplace.

Resale from a Registered Owner - You buy a property from someone who is already an owner of the property by virtue of having a registered sale deed in his/her name.

Resale from an Unregistered Owner (Assignment Sale) - You buy a property from an owner who has not registered the property in his/her name and is an owner by virtue of having only a sale agreement in their name.

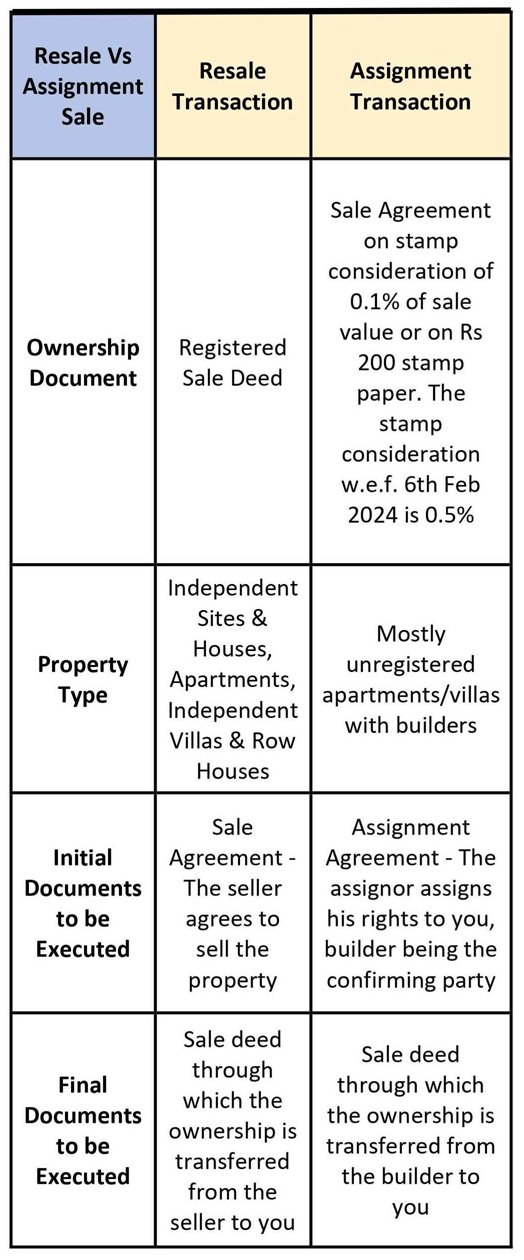

Before we delve into the details of the two transaction types let’s give you a table highlighting the basic difference between the two.

A snapshot of Resale Vs Assignment

Unlike a direct purchase from a builder the process here is a little different and exhaustive to comprehend.

You as a potential buyer would meet the re-seller online or through a real estate broker. Once you like the property you are suggested to Express your Interest - By way of a certain Token Advance and collect the property papers.

Let us highlight some of the possible complications arising in resale transactions leading to the deal cancellation and forfeiture of the token advance.

1) Seller’s Profile: A salaried seller will be fine with 100% white transaction but a businessman or a landlord kind of profile will have different expectations.

2) Seller gets a better price: Another potential buyer agrees to pay a lakh or two more than what you had agreed to pay. Take it from us, most sellers irrespective of their profile, will instantly disassociate themselves from Salman Khan and his commitment theory. If the seller is a salaried/corporate profile you may get back the token advance. In case of businessmen and landlord kind of profile that token advance is forfeited unless you have a written agreement in place.

3) Seller’s Existing Loan: The seller has an outstanding loan and the logistics of closing that loan does not match with the process & terms & conditions of the bank of your choice.

4) The Registration Value Mismatch: The seller wants to register the property as per government rates and the bank of your choice expects you to register it as per the market rate.

5) Deviation in Construction: The bank of your choice is not ready to fund the property as there is deviation between the actual construction and sanction plan issued by the sanctioning authority.

6) Legal Issues: The legal papers given to you after the Token Advance stage are incomplete & your lawyer or your bank’s lawyer wants more documents which the seller is unable to furnish. Or there are obvious legal complications in the property papers and therefore you decide against the deal.

In our experience of handling the finance for so many resale cases we have seen many deals being called off after this so called first step of expressing your interest by way of a token advance payment. In many cases the token advance is kind of gone unless there is a formal written agreement, which is seldom put in place at this stage. That’s like 25k to Rs 1 lac gone depending on how much you have paid.

So therefore, a resale transaction needs a different approach where you are able to establish the complete flow of events right through the registration in consultation with the seller & the bank of your choice.

loangebra can help you with the end-to-end process.

Please WhatsApp Us

or

Write to us at This email address is being protected from spambots. You need JavaScript enabled to view it.

Login

Login Sign Up

Sign Up