PMAY Scheme

PMAY Scheme: It is a game changer scheme in the affordable housing sector. The "Credit Linked Subsidy Scheme” (CLSS) under Pradhan Mantri Awas Yojana (PMAY) was announced by our Honourable Prime Minister Shri Narendra Modi in December 2016. The scheme envisages the vision of housing for all by the year 2022.

The underlying principle:

If all applicable conditions are met as prescribed in the scheme the central government will directly credit the applicable subsidy amount into your loan account at the end of 6th month of your loan tenure. This can be treated as a onetime prepayment amount.

This onetime prepayment by the government on your behalf will lead to the reduction in your principal outstanding and therefore a corresponding reduction in interest outflow thereafter. The overall gain in terms of interest reduction for the full tenure will be much higher than the applicable subsidy itself.

Let’s look at an example

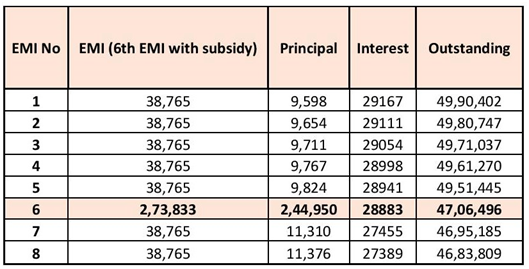

Loan amount of 50 Lakhs @ 7 % for a tenure of 20 Years. Considering a subsidy of Rs 235068 for the MIG 1 category, the loan schedule for the 6th month will look like this.

Your Gain: The subsequent reduction in principal outstanding and the corresponding reduction in interest arising out of this onetime prepayment is your gain. Not factoring in any further part payments by you the total interest saved over the full tenure will be Rs 6,26,265 and the tenure saved will be 22 months (Loan will be closed in 18 years & 2 months) …..Game Changer Indeed.

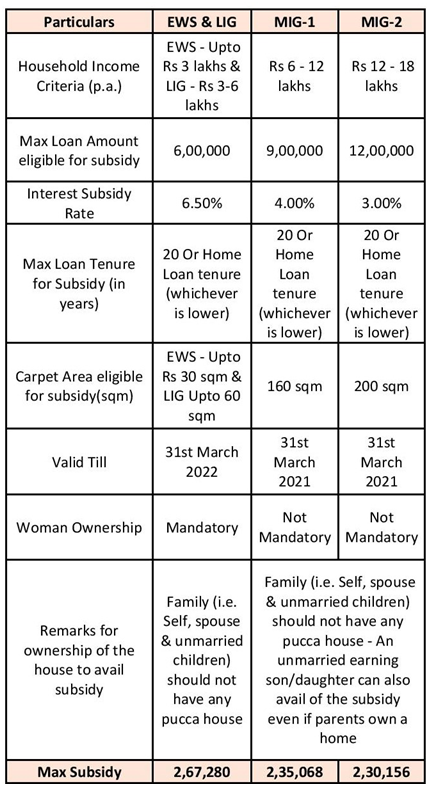

Applicable Conditions for PMAY Scheme

- EWS – Economically Weaker Section

- LIG - Low Income Group

- MIG – Mid Income Group

Note: The subsidy could be lower than this if the tenure chosen for home loan is less than 20 years.

Important Points for PMAYS:

1) After the reduction in outstanding principal amount the EMI can also be reduced but it is advisable to maintain the same EMI so that a bigger portion can go towards the principal every month.

2) There is no upper limit prescribed for the loan amount to be taken under this scheme. However, there is upper limit on the loan amount for the subsidy calculation under different income group.

PMAYS – Freaky Questions & Freakier Answers

Case 1: The combined income of a couple is 28 lakhs/annum. Husband earns 16 lakhs/annum and wife earns 12 lakhs/annum.

Question: If I don’t disclose my wife’s income, I will fall under the 12 -18 lakhs income bracket and can avail the subsidy?

Bottomline Consulting Answer: Please rise in honesty and do not try to fall under the category of dishonest people. The scheme is for more deserving section of the society than a family with Rs 28 lakhs of combined annual income.

Case 2: Two real brothers wanted to avail a home loan for close to 2.25 Cr for an independent house worth 3 Cr. Both are businessmen – One has a business in Chickpet area of Bangalore with annual T/O of Rs 8 Cr and the other brother has a similar business with annual T/O of Rs 5 Cr. They supply electrical goods to builders in the city & by virtue of barter system with these builders they now own 18 apartments across Bangalore earning rental income from all of them. These apartments are over and above the existing bungalow that each brother has. So that’s the profile of the loan seekers.

Question: Humko Pradhan Mantri Awas Yojna Milega Kya?

Bottomline Consulting Answer: Avashya Milega Sir. Aap Pradhan Mantri ko awaaz tho lagao…. Ve khud yojna ke kagaz pathra leke aap ke ghar pe prakat ho jayenge. "Aap keval Bhagwan se darna seekho aur kuch karne ki zaroorat nahin hai."

Login

Login Sign Up

Sign Up