Overdraft Home Loan

Over Draft Home Loan

This is a preferred product by a good number of home loan seekers. The nomenclature differs across banks. SBI calls it Maxgain, in Citi Bank it’s Home Credit and its Home Loan Advantage in Bank of Baroda.

The Underlying Principle: Emergency Funds parked in your Regular Savings Account or Fixed Deposits with yields of 3% to 7% pre-tax can be parked in your Home Loan Account charged @ 8.6% to 9%.

The difference is your gain.

The Options:

Option 1 - The home loan account itself serves as the max gain account. You need to move money into the home loan account to avail the benefit.

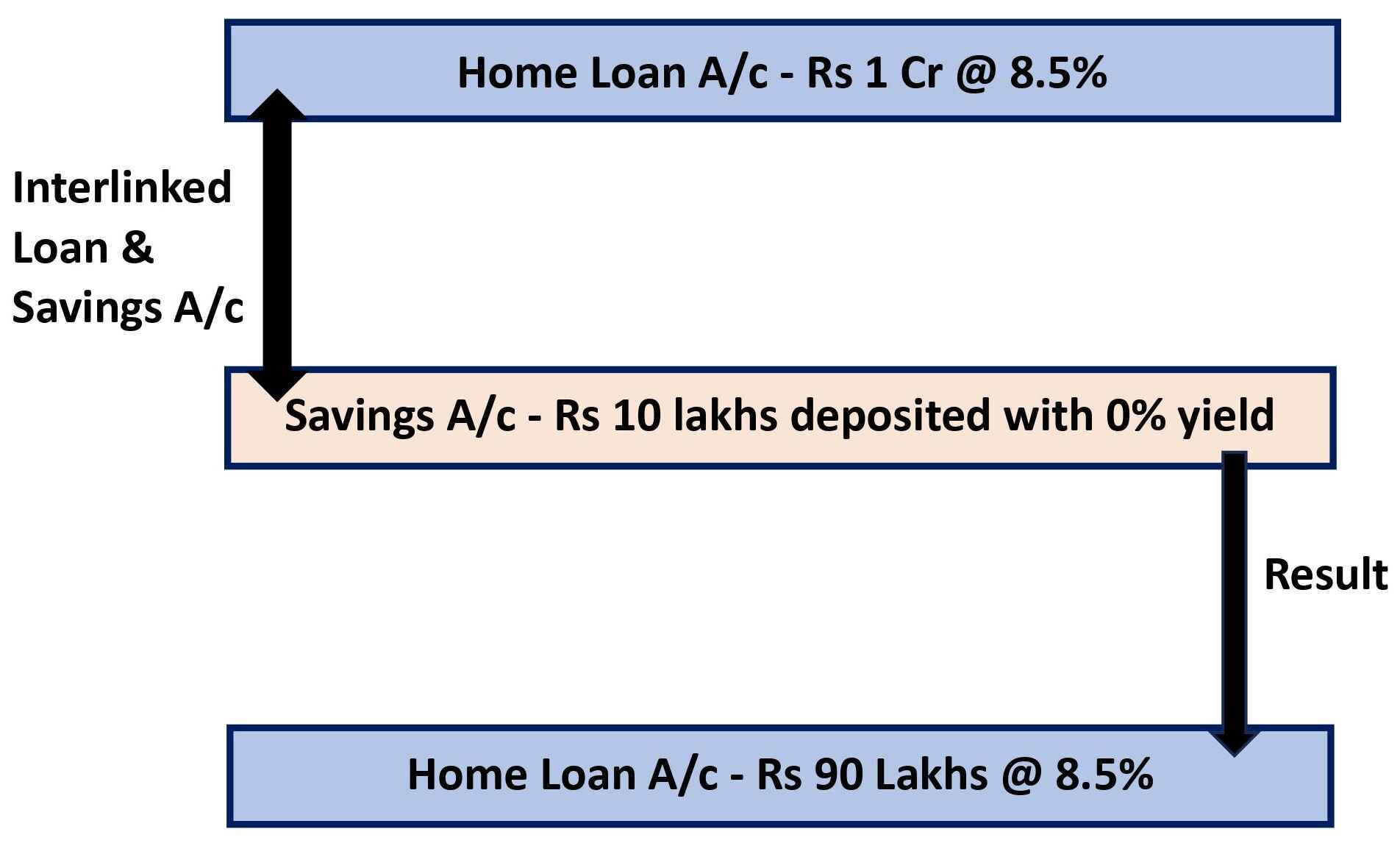

Option 2 - The home loan account is linked to a separate savings account. Any given amount deposited in this home loan linked savings account will not yield any interest to you. However, in the home loan account the interest will now be charged only on the residual balance after adjusting for the amount deposited in this particular savings account.

Example - Consider a home loan account where you have an outstanding of Rs 1 Crore and you deposit your surplus of Rs 10 lakhs into the savings account linked to the home loan account.

Home loan interest @ 8.5% will now be charged on Rs 90 lakhs & not on Rs 1 Crore.

Your gain is the difference between the home loan rate of 8.5% being charged to you and the possible fixed deposit yield of 5% (Post Tax) that you forgo which works out to 3.5% (8.5 – 5) for an amount of Rs 10 lakhs for the specific duration you park that fund in the savings account linked to the home loan account.

The Benefits

1) Absolute Savings - You save anywhere between 3.5 to 4.5% depending on the ROI being charged on the Over Draft loan, your tax bracket and the instrument where your money was parked (Savings Account/Fixed Deposits) before you moved it to the Over Draft account.

2) Tax Free Savings - You need not pay any income tax on the amount you save through this mechanism.

3) Instant Liquidity - You can withdraw the money from your savings account or the Over Draft account at a click of a button and use it for any other application.

Limitations – This product can be used to park your family emergency funds. The productive or growth funds should ideally find its way into asset classes with potential to generate wealth/returns. In a buoyant market scenario these assets could safely yield 10% to 12% pre-tax, if not more.

The Bottomline: In a scenario where the yields on savings bank and fixed deposits are low the Over Draft product is an ideal option to park your family emergency funds. The triple benefits of absolute savings, savings being tax free and instant liquidity are unmatched in any other contemporary financial products.

Login

Login Sign Up

Sign Up